Summary:

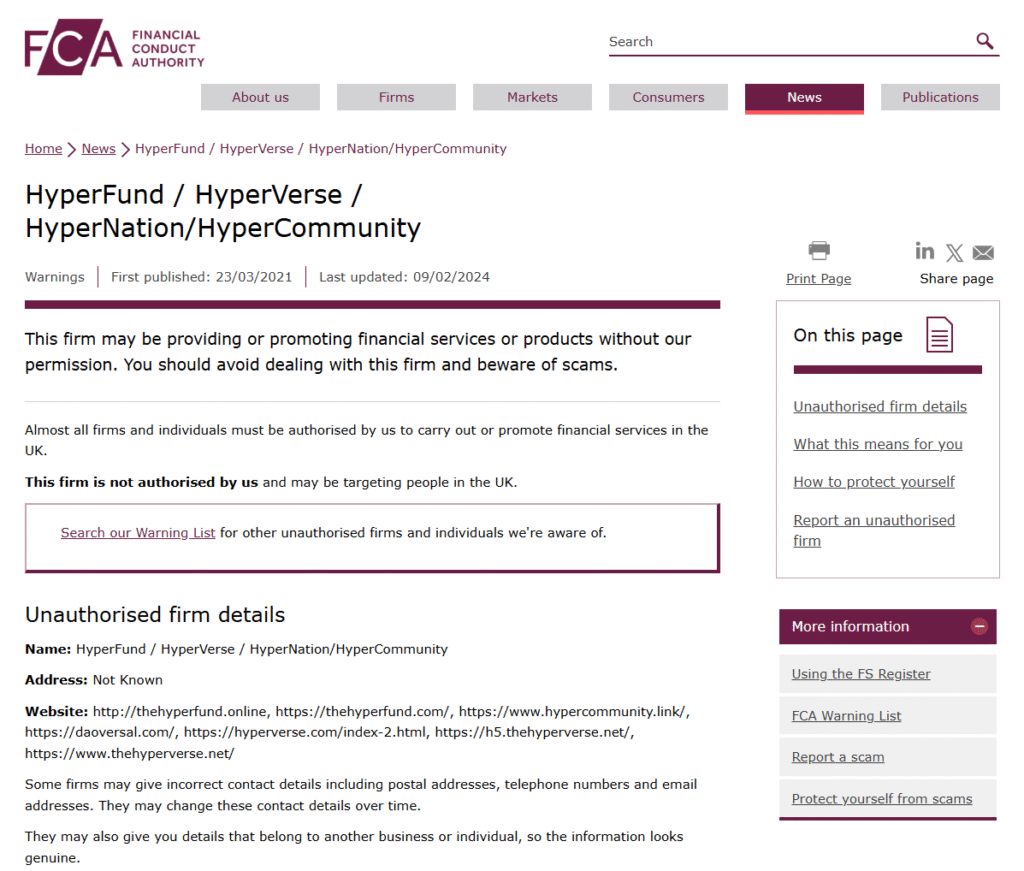

HyperVerse is a decentralized crypto platform founded by Sam Lee and Ryan Xu. However, HyperVerse was both a pyramid and a Ponzi scheme. It used fake endorsements, paid actors and employees, and fake promises to defraud investors around the world. The Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) have since released warnings against the fraudulent scheme.

- HyperVerse Website – http://thehyperfund.online, https://thehyperfund.com/, https://www.hypercommunity.link/

- Is HyperVerse Website Working – No

- HyperVerse Address – NA

- Is HyperVerse Regulated – No

- Is HyperVerse Blacklisted By Any Regulatory – Financial Conduct Authority (United Kingdom) and Australian Securities and Investments Commission (Australia)

- Is HyperVerse Domain Blacklisted – It seems there is no direct mention of this domain being on a blacklist.

What Is HyperVerse?

HyperVerse promoted itself as a decentralized, futuristic platform that featured not only cryptocurrency trading but also gaming and social networking. The platform attracted global investors with massive promises and high returns. HyperVerse was initiated by Sam Lee and Ryan Xu, who envisioned wealth and financial freedom through digital empowerment.

HyperVerse: Pyramid Scheme or Ponzi Scheme?

The Pyramid Scheme – HyperVerse cash flows started at the top and fell through commissions into the pockets of investors below who had recruited and earned commissions for introducing a new potential investor into the HyperVerse ecosystem, paid just for passing on news of the opportunity. The more people they recruited, the more money was promised. Hyperverse paid members for “memberships” and recruited other members. HyperVerse purposely encouraged aggressive recruitment and paid commissions [of up to 98%] as a “reward” to recruit, not because they believed there was actual value or “product” to sell.

The Shady History Behind the Founders

Lee and Xu both had previous affiliations with Blockchain Global, whose collapse left many investors with nothing. Lee and Xu have a troubled past steeped in controversy, not to mention that multiple regulators in Australia, the UK, and other countries have warned potential investors of the pitfalls of investing with them.

HyperVerse was not always named HyperVerse. It was also named HyperFund, HyperTech, HyperOne, and HyperNation, which is often how these companies escape their past and similar identity, and try to lure in new unsuspecting investors to continue the cycle.

HyperVerse: Pyramid Scheme or Ponzi Scheme?

The Pyramid Scheme Element

A pyramid scheme compensates users for bringing new members into the system. That is the more recruited members, the more money you are promised. HyperVerse encouraged investors to purchase “memberships” and then recruit others so that they could earn commissions from their recruits’ investments. This so-called ‘incentive’ promoted recruitment at all costs, and not any real value from a product or service.

The Ponzi Scheme Element

A Ponzi scheme uses money from new investors to distribute funds to previous investors. In HyperVerse, they said they were investing money in some profitable crypto investments. There are no records of any investments or profits being generated. The ‘returns’ were fabricated or taken from new investor deposits.

Fake Faces and Paid Promoters

Possibly the strangest aspect of HyperVerse was the appointment of Stephen Harrison as CEO. It turns out that he is a British actor residing in Thailand, who was hired for $4,000 to pretend he was running the company as the CEO.

The scheme also included a fake ‘endorsement’ by Chuck Norris and one by Steve Wozniak, which were just Cameo videos for which they were paid and contrived into endorsements.

Worried you’ve been misled by platforms like HyperVerse? Connect with LegalCertifi for expert guidance on recovering your funds and protecting your rights. Your action starts here.

Check more scam broker reviews here.

To receive current updates, you can follow us, receive expert opinions and warnings about scams, please join us on:

Leave a Reply