Uncovering the Truth Behind Validus Company

Summary:

Validus is marketed as a crypto-based, online trading platform, boasting up to 9% monthly returns, along with even more returns in the form of bonuses – the company has a matrix scheme. However, if we dig deeper, we will discover that Validus is not regulated, uses fake dashboards to mislead investors into thinking they earned money from their investment and engages in fraudulent activity. Recently, global regulators like the New Zealand FMA and Belgian FSMA have exposed the company as unlicensed and illegitimate. This platform is fraudulent and has left some investors high and dry, attempting to withdraw their funds, only to learn about the true nature of this Validus scam.

Website – https://teamsvalidus.com/

Website Working – No

Address – 403S, 1013 Centre Road, Wilmington, DE 19805, Delaware

Regulated – No

Blacklisted By Any Regulatory – 403S, 1013 Centre Road, Wilmington, DE 19805, Delaware and Financial Markets Authority (New Zealand)

Domain Blacklisted – It seems there is no direct mention of this domain being on a blacklist.

What is Validus?

Validus positions itself as an “online trading university,” and as such, offers financial education and investment options to potential investors. According to the Validus company, you will earn no less than 9% of monthly returns along with bonuses paid via a complicated matrix scheme. The platform has an attractive presence; a visible account dashboard displays so-called profits and associated awards that appear to lure investors.

While Validus appears attractively constructed, a closer inspection reveals a fraudulent operation. Investors are convinced to convert their funds to cryptocurrency and then transfer it to Validus, only to learn that the supposed ‘earnings’ were artificially confirmed numbers and there were no actual ‘earnings’ to back them.

How the Validus Scam Works

The Illusion of Profit

Victims are provided dashboards that chart ongoing returns and bonus plans. These numbers provide a false sense of achievement that compels users to invest more. This is a prevalent strategy that crypto-based Ponzi schemes employ, utilizing newer participant money to pay earlier participant returns.

Withdrawal Restrictions and Vanishing Contacts

Red flags appear when victims attempt to withdraw returns. Typical situations include delays, excuses, or no response at all. Unfortunately, as other victims arise with concerns, the faces representing Validus start to dwindle, effectively wiping out any link of communication.

False Compliance and Unregulated Operations

Validus states that they are Shariah compliant and have been deemed compliant through Global Islamic Financial Services (GIFS). Drafting laws are advisory firms and are not official regulators with the power to certify and license financial products.

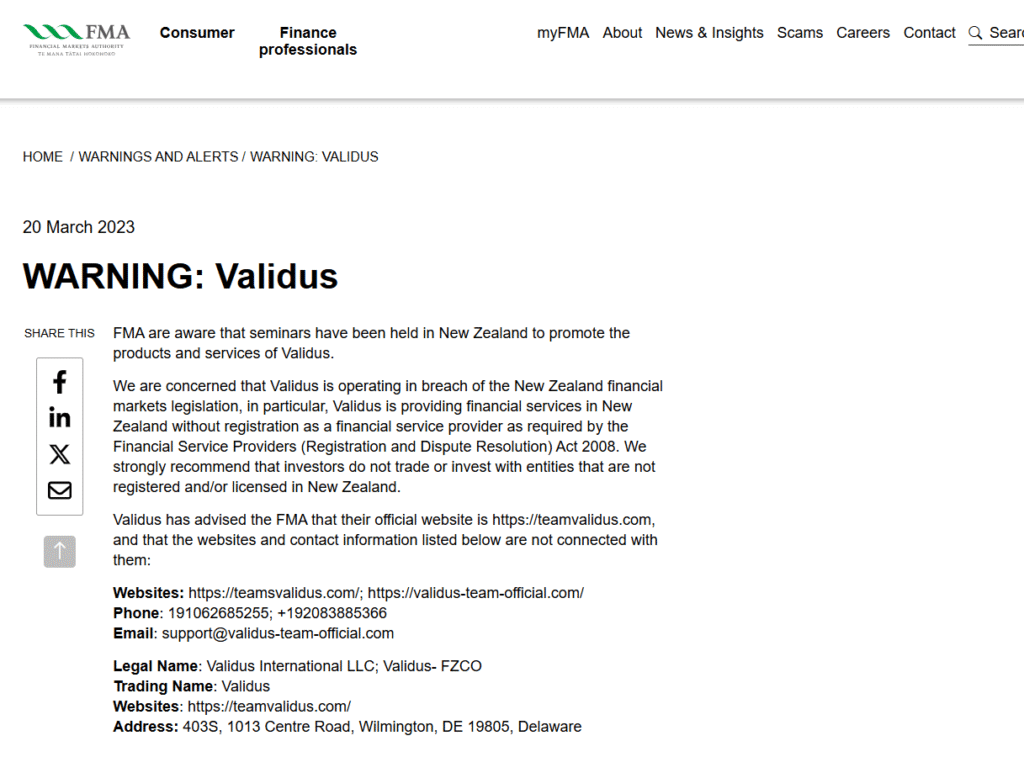

Upon additional scrutiny from regulatory bodies, they confirmed the deception of this entity:

- On September 15, 2022, the New Zealand Financial Markets Authority (FMA) announced that Validus was running illegally and was found to be illegally providing financial services when they were not registered under the Financial Service Providers (Registration and Dispute Resolution) Act 2008.

- Check FMA Warning – https://www.fma.govt.nz/library/warnings-and-alerts/warning-validus/

- There were also concerns in Belgium for Validus, as they were promoting training programs for trading complex instruments but had no local regulatory approval.

Think You’ve Been Misled by Validus? We Can Help.

If you’ve invested in Validus and are now facing withdrawal issues or suspect foul play, don’t wait. At LegalCertifi.com, we specialize in assisting victims of crypto-related schemes. Our experts can guide you through the recovery process with reliable legal support and personalized assistance. Take the first step toward reclaiming your funds.

Check more scam broker reviews here.

To receive current updates, you can follow us, receive expert opinions and warnings about scams, please join us on:

Leave a Reply